Calculate Pay After Tax Ireland

For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. Your gross income of 3333 EUR per month for a single person is.

Taxable Income Formula Calculator Examples With Excel Template

The latest budget information from January 2021 is used to show you exactly what you need to know.

Calculate pay after tax ireland. An increase in the Earned Income Credit from 1350 to 1500. If you make 61155 in Ireland what will your income after tax be. That you are an individual paying tax and PRSI under the PAYE system.

How Your Paycheck Works. We have few Irish calculators specific to taxes in Ireland. The results should in no way be viewed as definitive for personal tax purposes for your individual tax payment.

Hourly rates weekly pay and bonuses are also catered for. Annual Salary After Tax Calculator. The same as the median gross Dublin income of 3333 EUR.

This is known as tax allowance at the marginal rate. To use the tax calculator enter your annual salary or the one you would like in the Salary box. If you pay tax at 40 and you can claim it at the highest rate of tax you pay it will reduce your tax by 40 100 x 40.

If you have the same tax allowance of 200 but the highest rate of tax that you pay is 40 then the amount of your income that is taxed at 40 is reduced by 200 and so your tax reduction is 80 200 x 40. Because of the numerous taxes. Changes in Budget 2020.

TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. The latest budget information from April 2021 is used to show you exactly what you need to know. Applying the standard rate of 20 to the income in your weekly rate band applying the higher rate of 40 to any income above your weekly rate band adding the two amounts above together.

If your salary is 40000 then after tax and national insurance you will be left with 30840. Calculates pay-related social insurance. Choose your filing marital status from the drop-down box and choose your age range from the options displayed.

Calculate your income tax in Ireland salary deductions in Ireland and compare salary after tax for income earned in Ireland in the 2021 tax year using the Ireland salary after tax calculators. Higher than the median gross Ireland income of 3083 EUR. Hourly rates and weekly pay are also catered for.

If you have a pension which is deducted automatically enter the percentage rate at which this is. Salary after Irish income tax calculator. All of the potential deductions above vary according to your earnings.

The Salary Calculator tells you monthly take-home or annual earnings considering Irish Income Tax USC and PRSI. An increase in the Home Carer Tax Credit from 1500 to 1600. Calculates salary after income tax PAYE USC LPT for PAYE workers in Ireland.

This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your hourly rate will be 1923 if youre working 40 hoursweek. Even your marital status impacts your earnings.

Use Deloittes Irish Tax Calculator to estimate your net income based on the provisions in the latest Budget. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. For other sources of income and benefits in kind the calculator assumes that these.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Thats because your employer withholds taxes from each paycheck lowering your overall pay. This calculator is designed for illustrative purposes only.

If you are paid weekly your Income Tax IT is calculated by. Calculates Universal Social Charge. If the highest rate of tax you pay is 20 or the relief is restricted to the standard rate then the claim of 100 will reduce your tax by 20 100 x 20.

Why not find your dream salary too. Why not find your dream salary too. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Unfortunately there is no quick and easy one size fits all formula for calculating take home pay in Ireland. Compare Contrast With TaxCalc you will be able to see a breakdown of all your deductions from your gross pay and estimate how much a pay increase or deduction is going to impact on your pocket.

Ireland has one of the strongest economies in Europe relative to its population boasting the fourth highest GPD per capita in the world in 2019.

Excel Formula Income Tax Bracket Calculation Exceljet

Taxable Income Formula Calculator Examples With Excel Template

Latest Tds Rates Chart For Financial Year 2017 2018 Fy Ay 2018 2019 New Tds Limits List Table Fixed Deposit R Income Tax Income Tax Preparation Tax Preparation

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

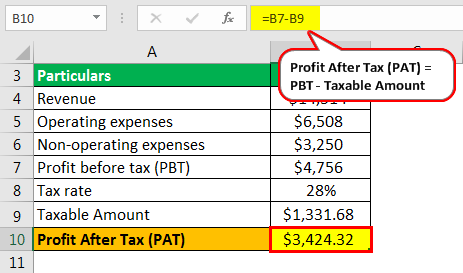

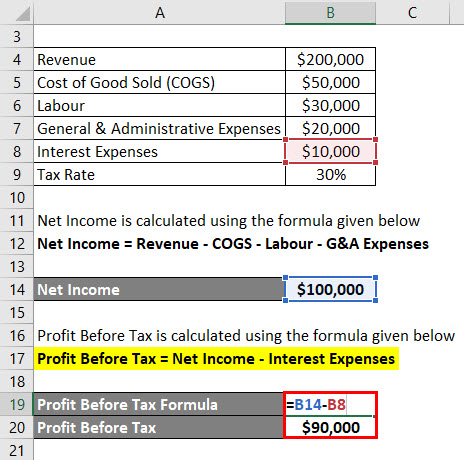

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Pin By Smithshah On Taxation Risk Free Investments Systematic Investment Plan Life Insurance Companies

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Payroll Taxes Payroll Taxes Payroll Bookkeeping Business

Find The Different Ways To Genereate Rent Receipt Online For Efiling Income Tax Income Tax Return Income

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Salary Formula Calculate Salary Calculator Excel Template

Disposable Income Formula Income Disposable Spending Habits

Tax Calculation Flow Chart Download Scientific Diagram

Nopat Formula How To Calculate Nopat Excel Template

Tax Calculator Calculator Design Calculator App Salary Calculator

Find Imposed Custom Tax On All The Products Imported In India With Custom Import Duty Calculator Seairexim

New Income Tax Slabs Extra Burden On Middle Class Easy Method Of Tax Calculation In Excel Youtube Income Tax Income Excel Formula

Posting Komentar untuk "Calculate Pay After Tax Ireland"