How To Calculate Zakat On Cash In Pakistan

Zakat on Cash and Bank Balances. These zakat calculators let you find out the monetary value of each type of wealth and then work out 25 of the total sum.

A Complete Guide To Calculating Your Zakat For 2021 Whenwherehow Pakistan

How to Calculate Zakat 2021.

How to calculate zakat on cash in pakistan. Zakat on cash becomes obligatory when the amount of cash whether held in bank or on hand fulfills Nisab. Stock held for resale should be calculated at the resale price not cost price. There are many charity organizations who give you a facility of zakat calculator which you can use to calculate your zakat amount.

Zakat is always calculated by taking into account the nisab. Answer By Dr Zakir NaikAs far as paper currency is concerned it is interchangeable with gold and silver we should try and find out the value of your paper c. Goodness is a vital part of human nature.

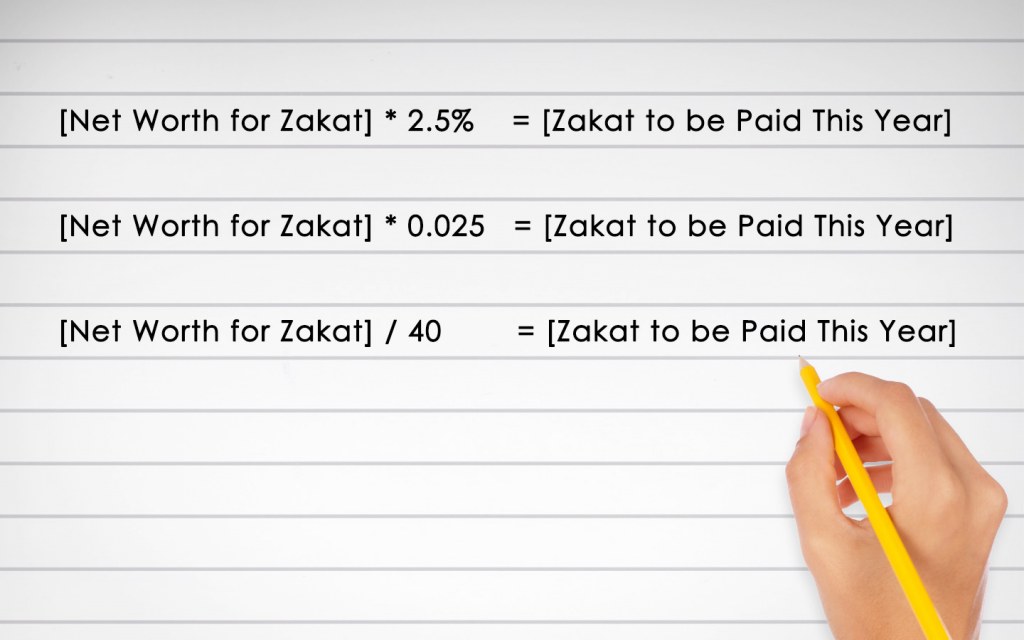

Zakat should be calculated at 25 of the market value as on the date of valuation Lunar date. The rate of Zakat applicable is 25 or the 40 th portion of your accumulated wealth for one lunar year. Thus we will multiply the net worth that weve just calculated with this rate.

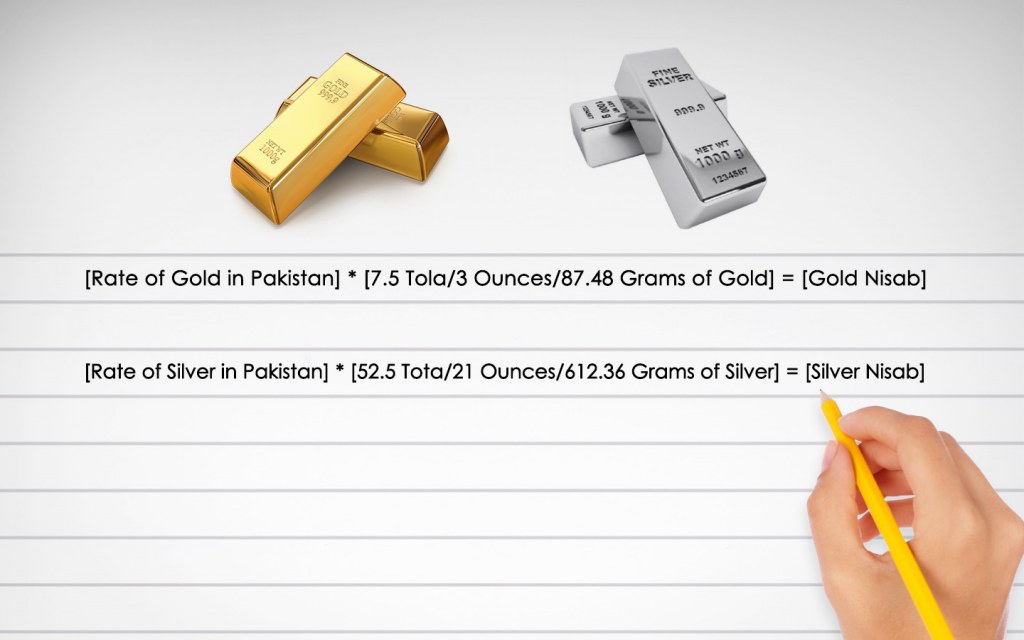

Zakat is to be paid on Silver in Pure form or Jewellery Utensils Decorative items and all household items including crockery cutlery made of silver at 25 of the prevailing market rates. Zakat nisab is generally set according to the cash value of 3 ounces 8748 grams of gold or 21 ounces 61236 grams of silver. Real estate because of the high degree of control associated with the property is preference for some people.

It is one of the important pillars of islam. This would typically include any cash stock held for resale debts that you expect to receive work in progress and raw materials. As an example if your assets like salary after any debts owed amounted to PKR 10000 then you would be required to pay PKR 250 as Zakat.

The percentage of Nisab that is payable as Zakat is a quarter of one-tenth 25 of the total. Total amount to be divided by 40. The Nisab according to the gold standard is 3 ounces of gold 8748 grams or its cash equivalent.

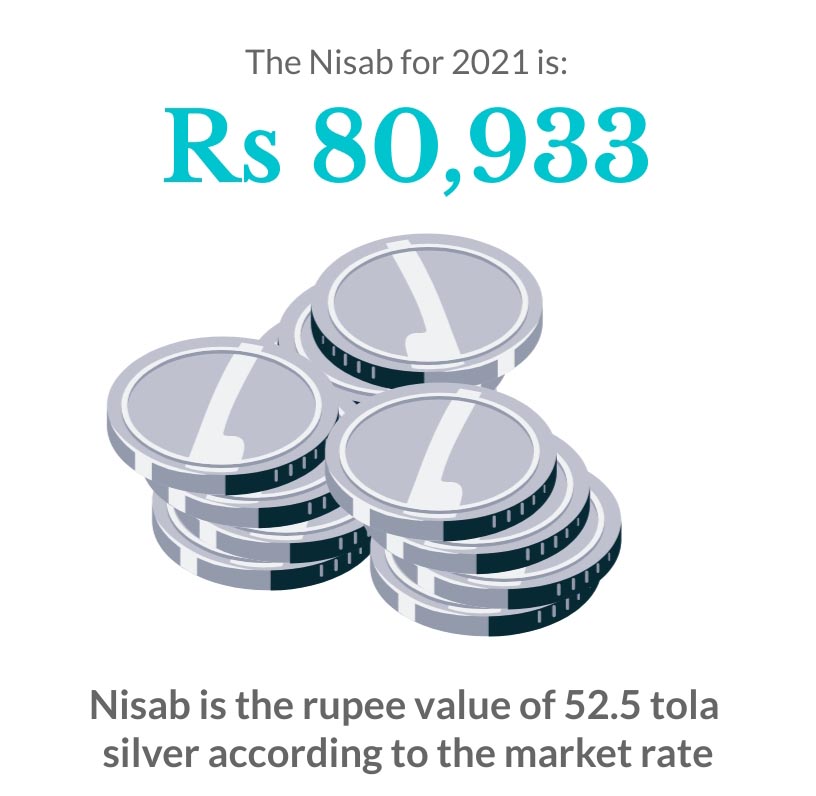

Do I borrow money from the bank to pay or is there something else I can do. Usually the government of Pakistan announces the Nisab for each year before Ramazan. Steps to Calculate Zakat on the Property in Islam.

PKR 850000 25 PKR 21250 Zakat to be Paid This Year Alternatively you can multiply the. Examples of non-liquid assets would be things like property and goodwill which are. It also includes money held in retirement and pension accounts.

Your Zakat donation should amount to 25 of your annual total wealth accumulated over the year. The nisab by the silver standard is 21 ounces of silver 61236 grams or its equivalent in cash. Nisab is the minimum amount that a Muslim must have before being obliged to give zakat.

Zakat should be paid at 25 on all cash balance and bank balances. Liquid in this case just means cash or other current assets that are easily converted to cash. Zakat is the obligatpry act ordined by Allah to be performed by every adult in islam.

Therefore zakat calculator Pakistan online wil calculate your zakat on assets you have with you at this time. There are many investment options in Pakistan but people are always confused between investing in real estate or stocks and investing in real estate or mutual funds. 25 x 12000 USD 300 USD is due for Zakat.

The wealth clean means a alot for adult and the zakat is the only way. Sarafa Bazar Boulton Market Mithadar Karachi. Zakat Calculator Pakistan 2020.

To calculate your Zakat for Ramadan 2021 add the value of your savings in cash shares and the gold and silver you own over your wealth then subtract them your bills house and food expenses and your dues. Amount on which Zakah has to be calculated 000000 Zakah-computing formula. To calculate Zakat now multiply 25 with the leftover amount.

The easiest way to pay zakat online is to first calculate your zakat amount. If I calculate zakat on the value of the property I dont have the cash to pay. Zakat means to be clear or increase even the meaning goes.

First of all calculate and review all the assets and cash that you. If this is a rental property meaning you dont plan to flip and sell it for instance you do not pay zakat on the value of the property but you pay zakat. How To Calculate Zakat On Salary In Pakistan.

One may calculate the Saleable Value of Items-at-hand on the date of Zakat Calculation.

3 Questions To Ask Before Zakat Donation In Pakistan

Calculate Your Zakat The Right Way In 2021 Zameen Blog

Zakat Calculator Pakistan 2020 Gold Rupees Excel Online

Calculate Your Zakat The Right Way In 2021 Zameen Blog

All You Need To Know About Zakat Deduction In Banks Zameen Blog

Faqs On Zakat Zakat Kae Sawal Help Poor Needy Ways To Communicate Faq Knowledge

How To Calculate Zakat On Gold In Pakistani Rupees

Government Of Pakistan Declared Minimum Limit For Zakat Deduction 2021 How To Avoid Deduction Youtube

Zakat Calculator Nisab Based Ramadan 2022 Calculator Bay

Alert Zakat On Gold 2021 Or Cash Govt Issues Zakat System Before Ramadan Youtube

Zakat Calculator Nisab Based Ramadan 2022 Calculator Bay

Zakat Calculator How To Calculate Your Zakat In 2021

Personal Zakat Calculation Part 1 Ramadan Ramadan Tips Person

Zakat On Money Calculation Of Zakat Om Cash And Saving Zakat

Zakat On Property How To Calculate It Where To Invest Capital Assets Property

Calculate Your Zakat The Right Way In 2021 Zameen Blog

Top Hospitals In Rawalpindi Top Hospitals Pediatric Surgery Best Hospitals

How To Calculate Zakat On Gold In Pakistani Rupees

A Professional S Guide To Calculating Zakat Profit By Pakistan Today

Posting Komentar untuk "How To Calculate Zakat On Cash In Pakistan"